PROVIDER INSURANCE CREDENTIALING AND STATE LICENSURE

We open closed panels and work with hard cases. Begin your journey with us!

More than

0

CLIENTS

More than

0

CLAIMS

per dayTailored

Dependable and efficient solutions, tailored to suit your precise demands

Trusted

Your trusted partner for billing and credentialing expertise

24/6 Support

Experience peace of mind with our dedicated support team, available 24/6 to assist you

We specialize in:

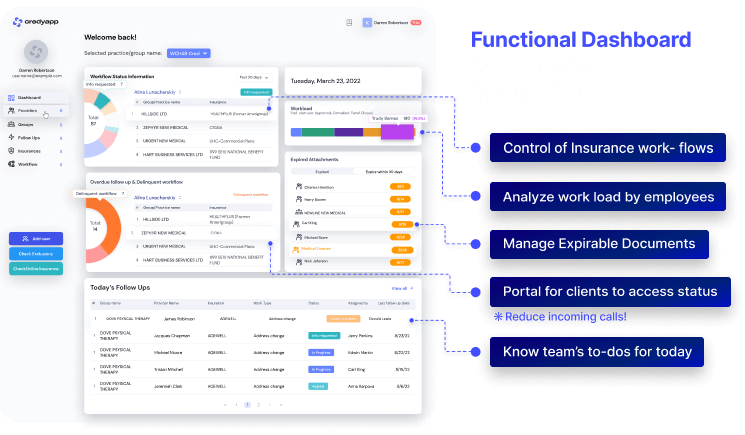

Manage, Control and Recharge your practice credentialing process

CredyApp is built to ease and improve the work for providers during the initial enrollment and insurance maintenance

Get DemoReasons to Choose Us

Conquering Challenge

A healthcare provider, hereinafter referred to as "the client," approached WCH with a perplexing issue. They were experiencing repeated denials for their Chronic Care Management (CCM) and Remote Therapeutic Monitoring (RTM) services, despite these services being covered by insurance companies. The client was baffled by the inconsistency in payments and was unsure why certain claims were denied while others were paid. The client had never closely monitored their billing and collections processes, but they began noticing a disturbing trend of month-to-month denials and a decline in revenue. The lack of understanding regarding these payment discrepancies prompted them to seek assistance.

WCH, with over seven years of experience in these types of medical billing and collections, took a comprehensive approach to address the client's concerns. Not only did we provide an audit of their billing practices, but we also offered insights from a collection perspective. Our team members were well-versed in dealing with various payers, understanding their guidelines, and knowing how to bill CCM and RTM services correctly and efficiently. Upon investigating the client's billing, we discovered that their primary insurance providers were Medicaid HMO plans in the state of New York. We realized that, unlike Medicare, which follows federal policies consistently across states and plans, Medicaid HMO plans had their own unique policies and requirements for processing CCM and RTM services. These plans sometimes used different codes, and not all codes were uniformly utilized. WCH provided the client with a comprehensive understanding of the intricacies of billing for Medicaid HMO plans. We shared valuable information, provided links to relevant sources, and proposed a more effective billing approach. We helped the client identify the services they had rendered and guided them on proper billing procedures. This newfound knowledge empowered the client to streamline their billing process and serve their patients more effectively.

The client, impressed by the expertise and guidance provided by WCH, sought a second opinion and eventually decided to switch their entire billing operation to our company. The transition was seamless, and we continue to work closely with the client to ensure accurate billing processes, efficient collection methods, and consultations on expanding their services to multiple states. This case study highlights how WCH was able to address the client's pain points related to billing denials and revenue declines. By providing a comprehensive understanding of Medicaid HMO plans and offering effective billing solutions, we enabled the client to take control of their billing processes. The client's decision to partner with WCH has resulted in improved billing efficiency and financial stability. Never underestimate the value of seeking a second opinion or expert guidance when facing billing challenges. WCH is dedicated to helping healthcare providers navigate complex billing landscapes and achieve success in their practices. We look forward to the opportunity to assist you with your billing needs and help you overcome any obstacles you may encounter.

FAQ

-

Can you help with credentialing with closed panels?Complexities with closed panels are to be settled on a “case-by-case” basis. Over the years, we have learned to navigate difficult cases such as closed panels. It is true that with thousands of new medical professionals graduating every year, there is not enough space at insurance to credential everyone. Clients that hire the WCH team to handle such cases are assured that our credentialing specialists will use all available resources: contacts, evaluation of practice location region, database of participating providers in the area and apply our knowledge and expertise to help our clients get into closed panels.

-

How long does it take to complete the credentialing process?WCH can complete the credentialing process for new providers within 90 days, for established providers that are making any changes within 60 days, for facility enrollment up to 180 days.

-

Can I begin seeing patients without completing the credentialing process with an insurance company?It depends on the patients’ insurance plans and benefits. Each patient has a specific health plan coverage that delegates the reimbursement and eligibility requirements. Nevertheless, the provider is financially responsible for seeing the patient before checking patient benefits and insurance credentialing requirements. From our experience, we can say that the majority of insurance companies prefer to pay contracted providers. Talk to us before making your decision. We can help to create a timeline and structure that will give you the possibility to get payments for your work.

-

Will I work with a specific specialist in the Credentialing Department of WCH?Yes, you will have assigned a credentialing specialist that will be the primary person for communication between you and the insurance company. You will be able to speak with the Credentialing Department Supervisor and Manager.

-

What happens if the insurance decides to reject application during the final review or reject an appeal?We do not stop even there is a rejection of an appeal or new enrollment. Our job is to get our client enrolled with insurance. Several steps that can be done to request reconsideration or second-level review. We have the experience to handle rejected cases in enrollment and second level appeals to help our clients to become accepted by the insurance.

-

Can a submitted application guarantee acceptance into the insurance network?No, submitting an application to the insurance does not provide a guarantee that insurance will accept providers into the network. Before submitting the application, it is crucial to find out if the panel is open for the provider specialty. Once the confirmation has been received, the provider can submit an application.

-

Do you recommend joining IPA or seek contracts directly?Our experience has shown that direct contracts are the best option for providers. However, considering the closure of plans for certain specialties, the amount of time it takes to complete one application to join insurance, IPA sometimes can work better for practice. However, we consult our clients always to go directly. IPA should be a last resort for healthcare providers.

-

If I have pending malpractice cases, should I disclose to the insurance?Yes, all pending cases or any type of open/closed case must be disclosed to the insurance company during the credentialing process. CAQH must also reflect your most updated information. Supporting documents for each must be attached to demonstrate the details.