As a financial advisor, I have daily discussions with people who ask me for help with building safe retirement for them and their families. This article is a short summary of my response to them. Building safe retirement requires a two-step process. First, an individual has to make a long-term commitment to putting away some money on consistent basis. Doing it occasionally is better than not at all, but the result may fall far short of expectations. Second, an individual has to decide where the money will reside. It is hard for me to do anything about the first part although, believe me, I try hard to keep my clients disciplined. The second part is definitely within my domain and as such is my primary focus.

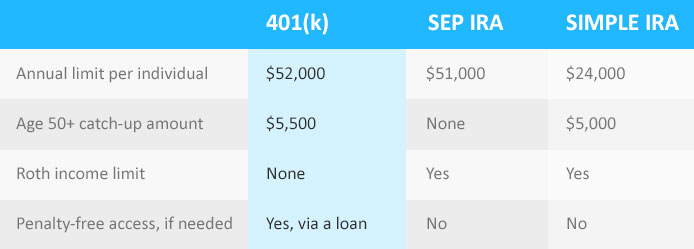

There are few options that open to the self-employed and/or small business owners. Among them three are the most popular: SEP IRA, SIMPLE IRA and 401(k).

SEP IRA is a sibling of Individual IRA, but has a higher limit (up to $51,000 in 2013). The pros of SEP IRA are low cost and simplicity to administer. The cons require some explanation. The first drawback is how the maximum amount is calculated. Generally, it is a lesser of 25% of income or $51,000. So, if a person makes $50,000, he or she can save $12,500 a year. The second drawback is that the owner must contribute the same percentage for himself and all his employees, who make at least $550 a year. That significantly increases overall cost of having SEP IRA.

SIMPLE IRA is another low cost, self-administered plan that provides an acceptable retirement solution. The pros are very similar to SEP IRA. Additionally, there is a higher limit for the employee’s eligibility, up to $5,000, which makes it less costly in case of employees. The plan is only available to businesses with less than 100 employees. The major cons of this plan are a required matching contribution of 2% by the employer and relatively low limit of maximum annual allocation of $24,000.

My favorite retirement solution is a 401(k) Plan. Many financial experts agree that this plan is the preferred way to help build wealth for retirement. Let’s start with the major drawbacks of this option. Like everything else in life, there are few of those. The administration is complicated and generally is done by a Third Party Administrator (TPA), which will cost you additional fees. The plan is a subject to annual testing (this is the main reason for a TPA), which focuses primarily on non-discriminatory treatment of the employees.

Obviously, it is much simpler for businesses where there are no employees, but a TPA is still required, albeit the cost may be lower. In some cases, employees may decide to waive the right to participate in the Plan, which also simplifies the compliance process. TPA is also responsible for checking eligibility of the Plan’s assets.

However, besides the issues that relate to the administration of the plan, 401(k) offers many befits that are not available with other options and can make a real difference in your savings:

- $500 tax credit plus deductions to lower your cost (for the first 3 years)

- The highest contribution limits among retirement options

- A Roth option with no income limits (within the existing Plan)

- Abundance of investment options determined by the owners of the business (yes, life insurance premiums can be deducted!)

- Loans from the Plan are available (up to 50% of the Plan assets limit to $50,000)

- The Plan’s contributions don’t have to be made every year

In conclusion, please take a look at available options:

If you would like to discuss, which option is the best for you or have a general question or comment, please contact Michael Pechersky, CFA at Eagle Strategies, LLC by calling (212) 261-0239 (work), (917) 318-5504 (cell), or by e-mail at mpechersky@ft.newyorklife.com